This year’s annual State of ABM Report is our most interesting one to date. Now in its fifth year, more than any of its predecessors, this report shows a huge change in how B2B marketing is done. The downstream effects of COVID-19 and shelter in place come into vivid detail as the report looks at how companies are rapidly adopting account-based sales and marketing practices. Not only that, it also shows how they have become nearly ubiquitous to the revenue strategies of today’s most progressive B2B professionals. With over 300 respondents representing our most diverse set of industries and company sizes to date, this year’s State of ABM Report marks a tectonic shift in marketing. We want to thank our partners, Salesforce Pardot, Ceros, Intelligent Demand, Convince & Convert, and FlipMyFunnel for helping us create this report.

Also be sure to register for an ‘unconventional’ webinar with Jay Baer to review our findings on 11/5.

Key Findings

COVID Spurred a Rush to ABM

Last year this report found 23% of respondents had no active ABM program. This year? Just 5.8%. We also saw a large increase in the number of respondents indicating that their program was in a “pilot” or “early” phase, indicating that we are seeing a large fledgling class of ABM practitioners.

A Continued Shift From “Leads” to “Revenue”

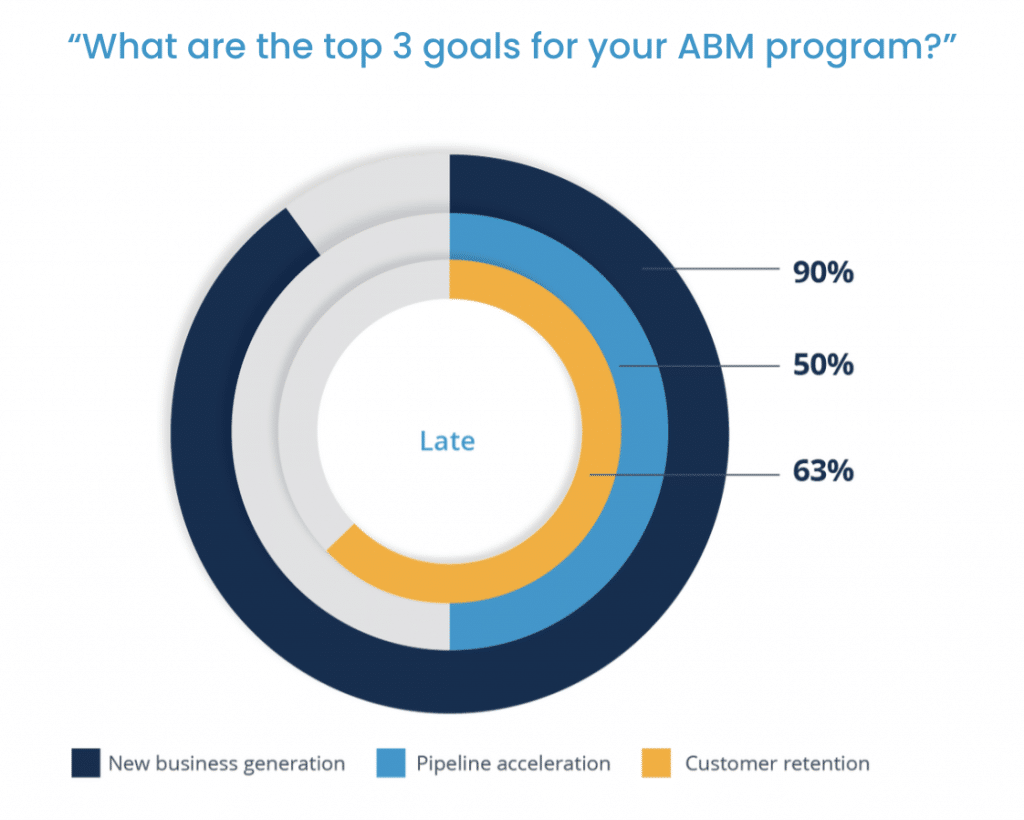

The one stat that every ABM practitioner knows by heart is, “less than 1% of leads turn into customers.” That fact shows up in stark contrast in this year’s reports. For teams early in their ABM journey, 42% of them said that “lead generation” was a top 3 performance indicator for their program. For more sophisticated programs, only 9% of them said it was a top 3 indicator, with “New Business Generation,” “Customer Retention” and “Pipeline Acceleration,” taking the top three spots. These top three were more important to mature programs than any other indicator – by nearly double. To be clear about it: for serious ABM programs, creating new revenue faster and then keeping it is the central focus for these practitioners.

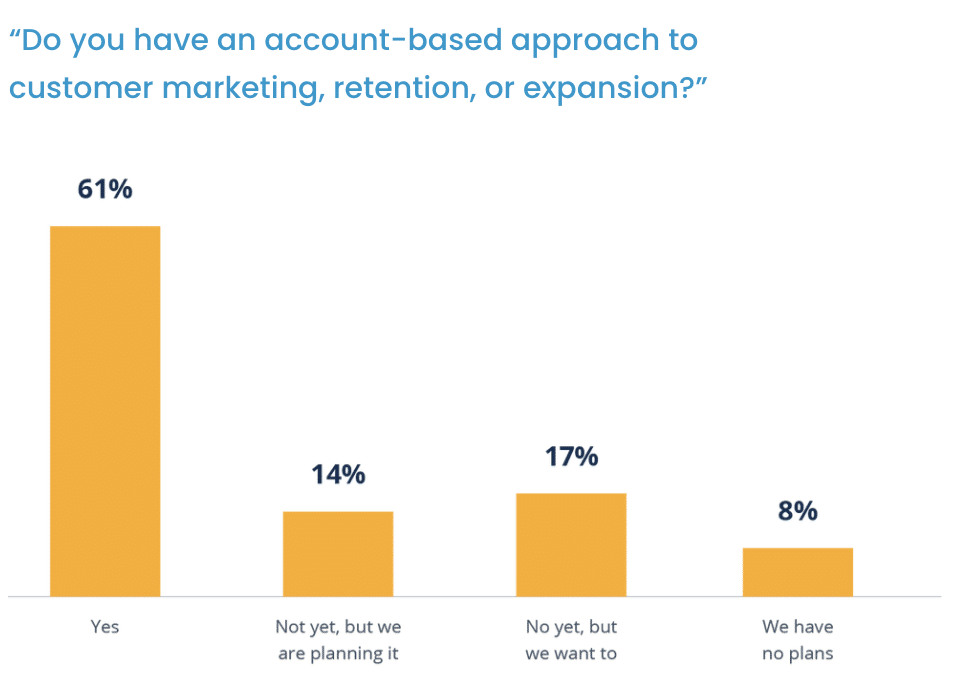

Retention Is the New Acquisition

This is a finding we expected to see since the onset of COVID. As budgets tighten, the revenue focus of companies needed to shift to customer-oriented programs to protect their existing revenue base. In last year’s report, we found that 38% of respondents had a customer expansion program. This year we found that 75% of them either had a customer marketing program in place or are planning one. For mature ABM programs, 80% indicated that they already have one in place.

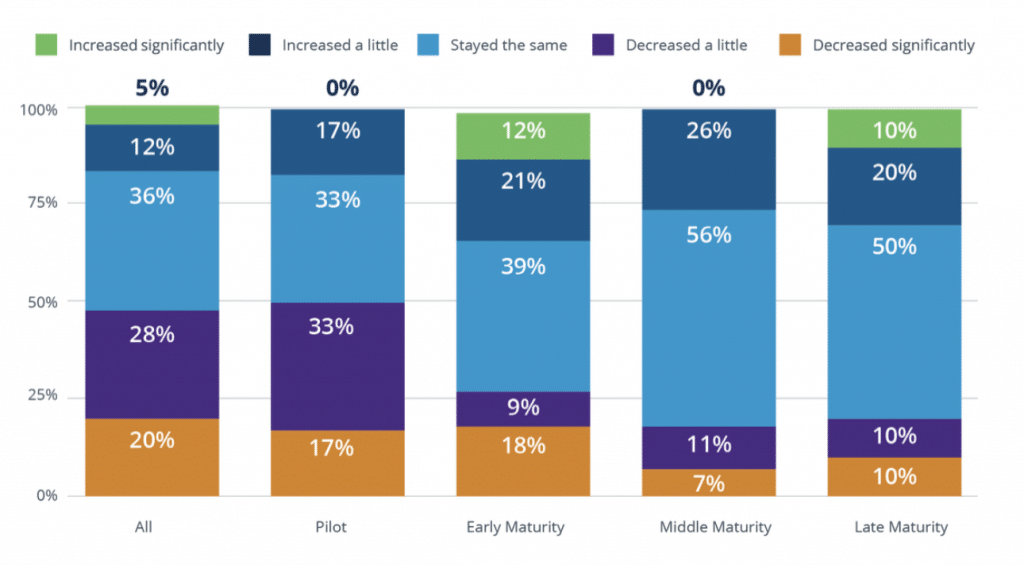

Mature ABM Programs Are Resilient

Looking at how budgets were impacted as a result of COVID-19 was of particular importance to us. Our findings aligned closely with Gartner’s mid-year CMO Spend Survey, which found that 40% of respondents had their budgets decreased. In our study, we found that 48% of respondents’ overall marketing budgets were reduced. One of the most fascinating findings of our study, however, was that the budget dedicated exclusively to ABM programs was resilient, with 80% mature ABM programs saying their budget remained or increased. Even for companies that had their overall budget reduced, they were still dedicating the same amount of budget or more to their ABM programs.

2020 Is the Year B2B Marketing Changed Forever

Even in their adolescence, “pilot” and “early” maturity ABM programs say that their account based programs are responsible for 18% and 20% of their company’s overall revenue respectively. As programs mature, however, their account-centric efforts become the overwhelming source of revenue, with reports showing that 79% of their company’s opportunities and 73% of their total revenue is credited to their ABM program. As ABM becomes embedded in a company’s revenue strategy, it becomes synonymous with their demand strategies. If we conflate the huge influx of “early” maturity ABM programs with the revenue performance of “mature” ABM programs, we’re about to see a new generation of account-based practitioners eschewing legacy demand generation tactics and replacing them with more efficient and productive account-based strategies.

In short: B2B marketers are waking up to a better way to drive revenue and it’s only a matter of time before ABM becomes the dominant strategy for today’s leading companies.

Read all of the findings in the 2020 State of ABM Report here.